The new gold rush: trader Michael Salib says some rivals are luring customers in to selling at well below the going rate. LAST week, as the European economy went down the toilet, Michael Salib of Cash for Gold Australia at Richmond bought $150,000 worth of second-hand gold rings and bangles. The two events are closely related.

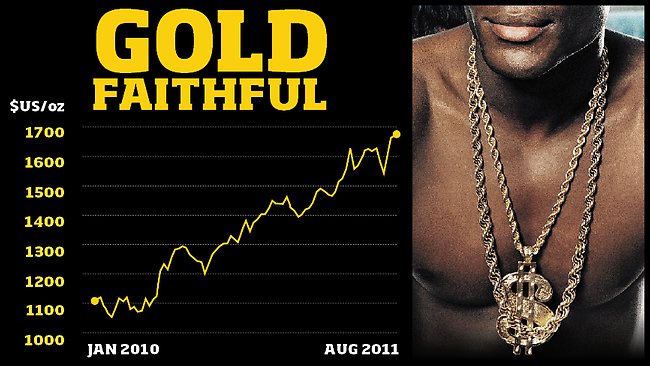

Ever since the financial crisis cranked up, the price of gold has been climbing -sparking a ”war” between new and old players trading in recycled gold, looking to cash in.

But as The Sunday Age has found, some traders say their rivals are offering prices well below the market rate. ”Some people are ripping off the public,”Mr Salib said.

In the past, those wanting to hock their unwanted gold took their chances at pawnshops. Now they are faced with aggressive marketing by big business. ”Everybody started jumping on the wagon, trying to get a piece of the action,” said Mr Salib, whose company Cash for Gold Australia first opened in 1996. ”We’ve been seeing new businesses starting up online every week, and some of them have copied our own website word for word. Even the spelling mistakes.”

Two years ago, Mr Salib was spending $2000 on buying gold per week. ”The price of gold has doubled since then, and now every week we’re spending over six figures,” he said. Business went into overdrive when he took Cash for Gold Australia online and started promoting ”gold parties”- a variation on the Tupperware party, where your mates turn up with their unwanted bling, and a consultant spends the night weighing each piece and calculating its value against the daily US price for bullion.

The gold party idea has launched an entire online-based industry, with companies named Gold Parties and Gold Parties Australia. The most aggressive company on the market is Gold Buyers Australia, founded in May last year. In less than 12 months, the company has established more than 200 kiosk-style stores in shopping centres across Australia and, according to several gold-recycling organisations who spoke to TheSunday Age, its slick marketing campaignis paying dividends.

All the organisations, including some operating interstate, complained that Gold Buyers Australia was attracting customers with their high visibility – but paying them below the market value for their gold. The company also promotes parties on its website, and recently launched a television campaign aimed at young women running short of cash while shopping for clothes. The marketing stresses ”convenience” and”safety” rather than good value.

As of Friday, according to his website, Mr Salib was buying nine -carat gold pieces for $14.90 a gram. David Edmonds of Citigold jewellers in Brisbane was payingabout $13 a gram. Both men believed that Gold Buyers Australia was paying between $6 and $6.50 a gram.

”They’ve made a big deal about it being better than going to a pawnshop, but you’ll get a better deal from [pawn broking retail chain] Cash Converters,” Mr Salib said. A call to Cash Converters by a Sunday Age reporter posing as a customer found the company was paying $9 a gram.

These claims were put to Gold Buyers Australia by email, with a list of questions about how valuations are calculated. The answers, via a PR company but attributed to company director Wendy Stewart, were vague. Using old-fashioned acid scratch tests, consultants calculate ”an accurate wholesale/second-hand market price that we are prepared to stand by”.

And:”It is important to note that the price promoted on the stock exchange does not directly translate down to the purchase price of an item. There are many other variables that are taken into consideration.”

The PR company, DEC Communications, said Wendy Stewart would contact The Sunday Age to confirm what price Gold Buyers Australia was paying its customers. At the time of publication she had not made contact.

A spokesman for Consumer Affairs Victoria said: ”When dealing with vulnerable consumers, traders should advise them the price is less than the market price.

If traders don’t disclose this information, they could be engaging in unconscionable conduct.”

Such conduct could also breach the Fair Trading Act 1999.